by Kevin Killough

The Securities and Exchange Commission’s (SEC) has been slammed with comments from supporters and critics of its proposed climate disclosure rule.

The release of the final rule has been continually delayed, but its publication is anticipated in the next few months. Congressional Democrats are urging for it to be done sooner rather than later.

The proposal, which was first released in March 2022, would require publicly traded companies to provide information about carbon dioxide emissions related to their business, when registering with the SEC and in their periodic reports. The comment period for the rule was extended past the original deadline.

Gary Gensler, SEC chair, said in a statement that investors want the rules because the information would provide relevant information helping them make informed decisions about financial risks to companies stemming from climate change.

Kathleen Sgamma, president of the Western Energy Alliance, told Just The News that the rules place a costly administrative burden on companies, a cost that will be passed down to consumers.

“It’s hard to draw that line exactly what the impact on consumers would be, but when you put this in conjunction with all the other regulations that this administration is piling on,” the impact will be high, Sgamma said.

Citing data from the Committee To Unleash Prosperity, Sgamma said, were it not for the Biden administration’s policies so far, the U.S. would be producing 2 to 3 million more barrels of oil per day. The SEC disclosure rules, she said, just add to these burdens. Sgamma also said the SEC rules, in regulating emissions, would also exceed the commission’s authority, which is the purview of the EPA under the Clean Air Act.

“Requiring greenhouse gas emissions disclosure is absolutely redundant with the EPA, but with none of the rigor and support the EPA provides,” Sgamma said.

In comments to the SEC that the Western Energy Alliance and U.S. Oil and Gas Commission filed, the two industry groups questioned how much support from investors the rule is receiving, as the SEC has claimed.

“The activists and investors SEC is relying on are overwhelmingly foreign and organized for advocacy by a small group of international organizations,” the groups stated in their letter. According to Sgamma, the Western Energy Alliance analyzed the number of investor groups who the SEC claims want the new disclosure rule, and found that more than half were European companies, and only about 7% of the investment managers in the U.S. support these disclosures.

Investment managers are individuals or organizations who are hired to handle activities related to financial planning, investing, and managing a portfolio for their clients. “Other than foreign pressure, the desire for this information is very limited in the United States,” Sgamma said.

Banks have also received a lot of pressure from climate activist groups to support the disclosure rules, such as the nonprofit Ceres, which reported over $31 million in revenue in its 2021 tax filing.

Ceres published a report in August rating banks on their commitments to upholding the goals of the Paris Agreement, an international agreement to lower carbon dioxide emissions. “Recognizing their influence, banks, especially larger institutions, should also take an active role in proactive climate action to positively impact both greenhouse gas trajectories and global economic stability,” the group stated in a press release announcing the report.

In its comments to the SEC on the proposed disclosure rule, Ceres expressed strong support for the rules.

The House Judiciary Committee is investigating Ceres, according to the Daily Caller, over concerns the group’s activities amount to collusion, which may violate antitrust laws.

Just The News reached out to Ceres for comments on the allegations and didn’t receive a reply.

Gensler, the SEC chair, indicated that the commission may be walking back some of the more serious disclosure requirements, which are called Scope 3 disclosures. Scope 3 emissions are any indirect emissions from a company’s activities from the extraction of the raw product to shipping to the store to the retail sale.

During a presentation for the U.S. Chamber of Commerce, Gensler discussed the proposed rules and response they’ve received. Moderator Tom Quaadman, with the Chamber of Commerce, explained the difficulty of Scope 3 disclosures in an example where his wife goes to buy milk at a grocery store, which is then required to disclose the emissions from the cows that were milked to produce the purchased product.

“The auto manufacturer who made my car has to, you know, disclose emissions,” Quaadman continued. “There are 30,000 working parts of my car. There are public companies above, and that has to be disclosed. The insurance company that insures my car has to disclose those emissions.”

Gensler clarified that the disclosure would only be required if the Scope 3 emissions are material to their operations, as determined by the registering company, or if they’ve made a public commitment to manage Scope 3. “It’s good that it’s not as egregious with the Scope 3 emissions, assuming they do indeed take Scope 3 emissions out. Scope 3 emissions are just ridiculous,” Sgamma said.

While the final SEC rule will likely be more watered down than the proposed rule, there will likely be additional administrative burdens in complying with whatever rule is finalized.

And it might not end with the federal government. California this month became the first state to pass a climate disclosure law, which follows European climate disclosure laws. When it comes to climate laws, states often follow California’s actions.

In the federal government’s quest to limit emissions, agencies have faced lawsuits for exceeding their authority, and it’s likely the SEC’s final rule will face similar legal challenges.

– – –

Kevin Killough is a reporter at Just the News.

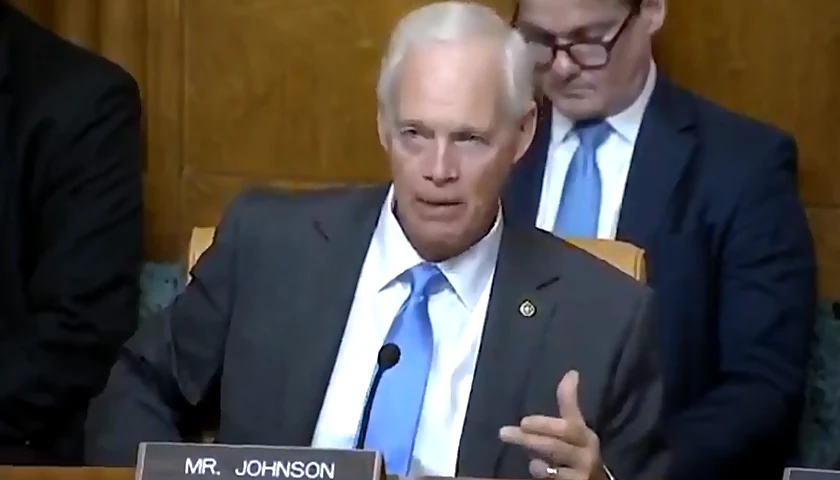

Photo “Gary Gensler” by Third Way Think Tank CCNCND2.0.